Weekly Forex Majors and Dollar Index Outlook

The U.S. Dollar Index mostly traded sideways in the last week where it started the week on a negative note and continued the week with mixed emotions but it managed to give a positive ending of the week by gaining 0.83 points in the last trading session of the week and closed the week on a flat note.

This week is going to be a very important week for the Dollar Index as it will decide whether the U.S. dollar will head back up again or it will continue its short-term bearish movement in the coming future as well.

On the technical grounds, the Greenback is showing signals of a potential bullish movement in the coming future if it manages to cross the short term resistance zone near 105.20 levels in the coming week. We expect the coming week to be a highly volatile week for the U.S. Dollar Index and if the Index will cross the resistance zone of 106.00 in coming trading sessions then it may again turn bullish and give a positive start of this month, however, the movement in the U.S. Dollar Index largely depends on the developments in the G20 summit.

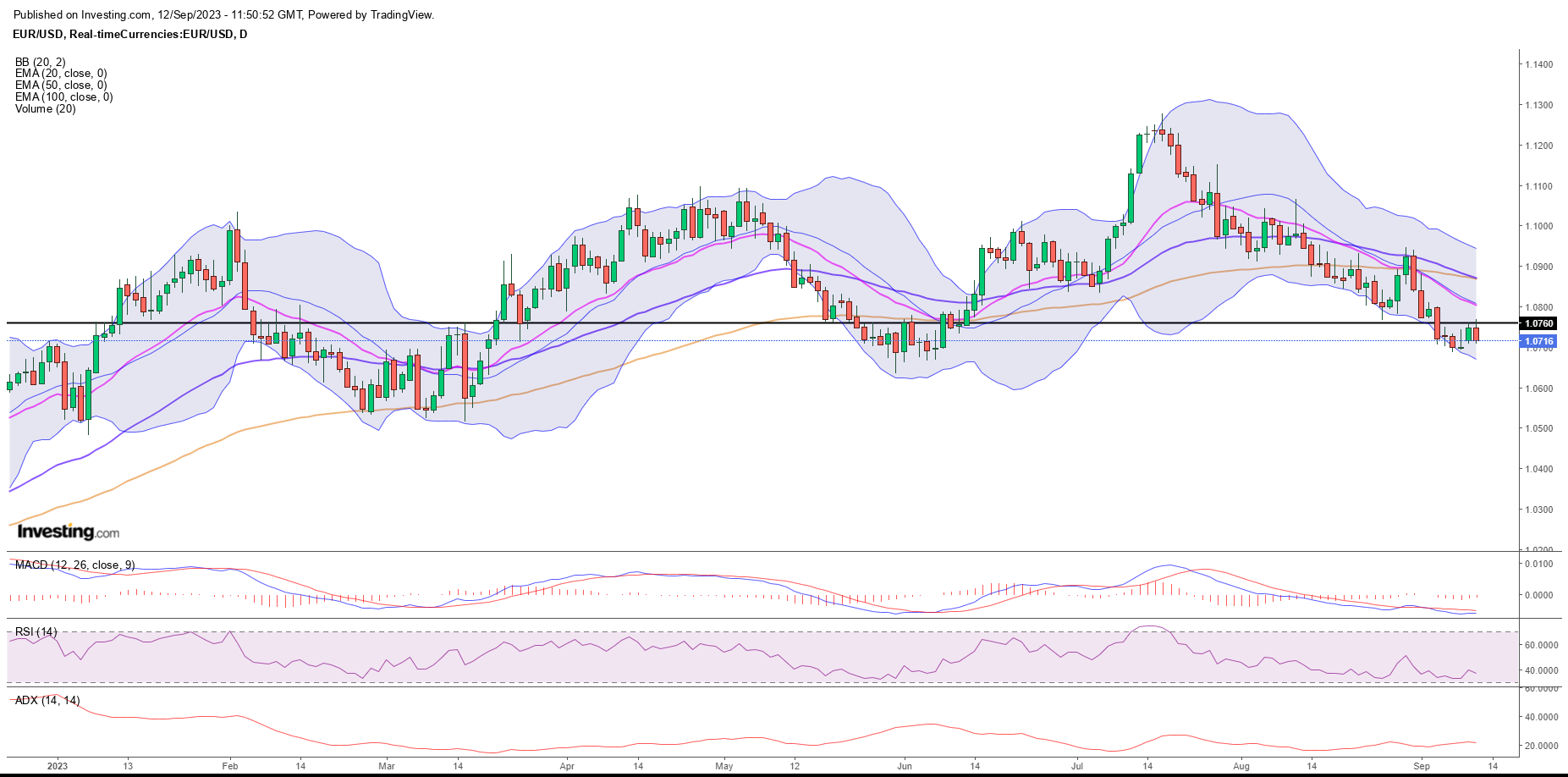

EUR/USD Forecast

Last week was a consolidation week for Euro where the currency gained some points in the starting of the week due to the negative movement of US Dollar but faced resistance near the 1.0760 levels and dropped in the last two trading sessions by setting off all the gain it made in the starting of the week and gave a flat closing of the week.

The upcoming week is also expected to be a tough week for the Euro as in the absence of any important economic reports or speech from the euro front it is expected to be a heavy push and pull between bulls and bears which may result in yet another flat week ahead.

Technical outlook: On the technical ground the EUR/USD pair is giving signals of a potential bearish movement in this pair and it is expected to test the support zone near the level of 1.0535 in near term. If the EUR/USD pair crosses the short term support zone of 1.0680 in the starting for the week, then it may result in a deep fall in this pair which can give the control of this pair to bears again.

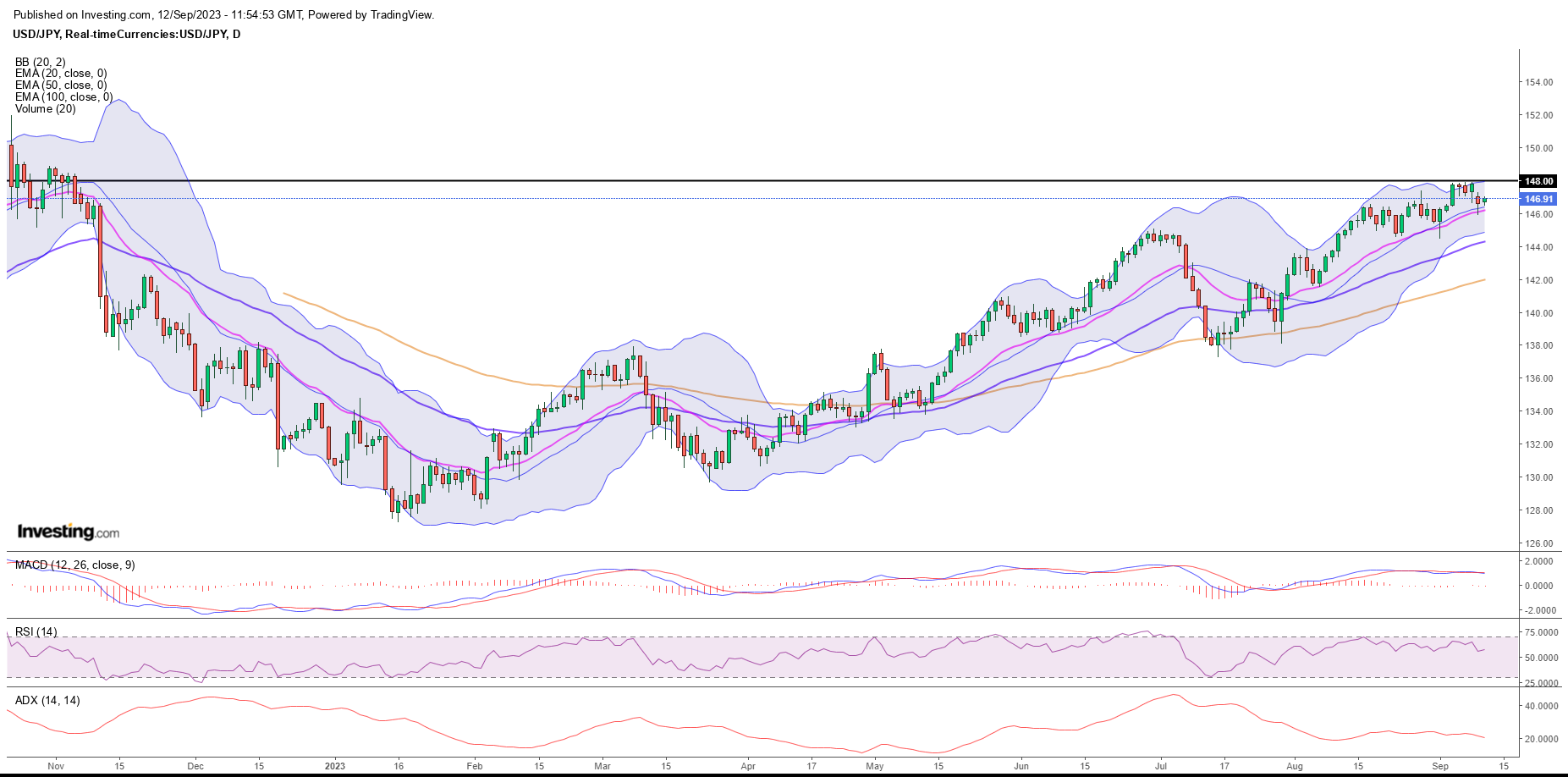

USD/JPY Forecast

On the economic front, The Japanese yen is expected to give a flat week too this week as there is no important data due this week.

On technical grounds JPY is getting weaker due to a bigger gap in interest rates between Japan and US, which is incentivizing traders to sell yen and get dollars. However, if the bullish movement of the US Dollar continues in the coming week then we can expect a breakout from the resistance level of 148.00 in the upcoming week.

GBP/USD Forecast

The pair had been bearish since last week and the downtrend in the pair is clearly visible on the weekly chart. The downtrend in the GBP is still on the move and it is expected that the pair which had experienced resistance near the zone of 1.2520 levels can give a negative movement this week and again start falling in near term as the Pound is still not getting any positive push which is keeping the overall sentiments for this pair negative.

On the economic front there aren’t any positive developments in the Economy which are continuing to put bearish pressure on this pair and the bulls are still sitting on the bench and waiting for a positive Economic outcome to jump back again in the market and give this pair some relief from the recent drop.